Well, it was worth the wait - at last the roll over. But what is interesting is the current game of "find the fact" with which to explain the down turn. As previously mentioned, TMM have been looking for a turn based on technicals and psychology with diminishing surprise at relatively good data adding to the turn. Yesterdays trigger appeared to come from "Things Chinese" rather than the more oft quoted concerns over Greek PSI or whatever other Eurowoe is in fashion. In fact EUR/AUD's rally could be seen as testament to this.

So with Chinese news under the spotlight TMM were somewhat taken by this morning's "accidently on purpose" leak of China's February Export numbers to the party faithful by Minister of Commerce Chen Demming. TMM's collective jaws drop at the combined January and February export numbers only posting a 7% rise. Or in layman's terms, shit. Using TMM's sticky-back-plastic/cereal box seasonal adjustment tool (see below chart), that would suggest that Chinese exports had fallen YoY for the first time since the 2008 trade shock. Which isn't particularly good.

But TMM reckon something smells. Because such a collapse in export growth would suggest that external demand had completely cratered which, according to data in the rest of the world (e.g. the PMIs) seems not to be the case. Something does not add up. Time for TMM to put on their data torturing investigative hats.

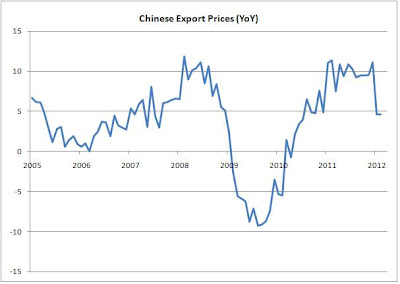

Aside from the usual complaints about China's data being manipulated for political reasons (shock! horror!), it also isn't very good in terms of statistical availability, because the actual important metric is trade volumes rather than trade values, at least from the view of Joe Sixpack. Because if the price of something the US (or EU or wherever else) consumer buys falls, he/she can obviously buy more of it or alternatively, has more money to spend elsewhere... like on gasoline. And this is particularly interesting given that the steel, iron ore and coal within mainland China appears more offered than a night out with Ed Miliband at the Fascist Elocution Society's Annual Ball. So that got TMM thinking... we wonder if the domestic tightening and slowdown ongoing within China had made its way through to export prices. And while some of the this move is clearly base effects, it does seem as though export price inflation has hit a wall (see below chart). So this might provide some reason as to why the reported export numbers were so poor.

To try and see if this is indeed the case, TMM tied the data to their Rack and had a go at trying to extract signal from the noise by attempting to adjust for Chinese New Year and Export Prices. Happily, this fudge adjustment shows real exports growing at just shy of 10% YoY. They then knocked up a quick Blue Peter-style model of Real Chinese Export Growth based upon lagged US/ EU PMIs & their Orders/Inventory balances and came up with a reasonably OK fit (see chart below). In fact, it would seem that this naive model would have expected a more dramatic drop off in export growth, with a rebound over the coming months.

Now, TMM always take everything with a pinch of salt and are certainly on the alert that if the trend does not reverse soon, then something is afoot. But for now, it looks a case of "Move along, nothing to see here".

No comments:

Post a Comment